Investing in Indian Textiles – Opportunities & Insights

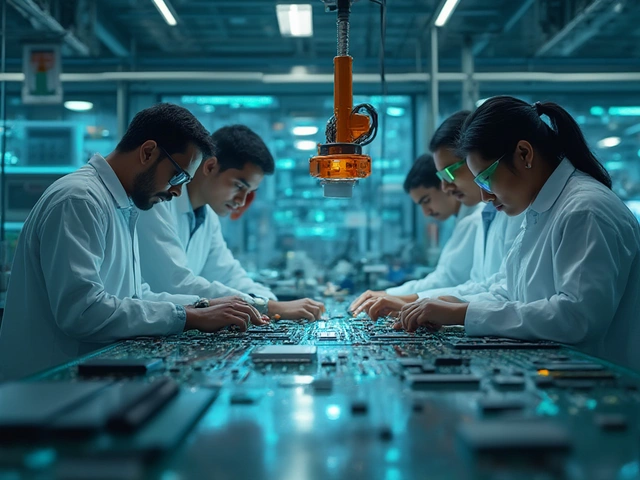

When talking about investing in Indian textiles, the practice of allocating capital to companies and projects within India’s textile sector. Also known as Indian textile investment, it offers high growth potential due to strong domestic demand and export strength. Investing in Indian textiles isn’t just about buying shares; it means understanding a network of factories, design houses, and logistics hubs that together shape the market. The sector is a major employer, a source of foreign exchange, and a driver of innovation in fabric technologies. In short, the more you know about the underlying ecosystem, the smarter your capital allocation becomes.

Core Elements Shaping the Investment Landscape

The Indian textile industry, one of the world’s largest manufacturers of cotton, synthetic, and blended fabrics forms the backbone of any investment thesis. It produces everything from raw yarn to high‑end fashion, feeding both domestic retailers and global brands. A crucial driver is the Surat textile hub, a coastal city known for its high unit count, advanced infrastructure, and strong export links. Surat’s concentration of spinning, weaving, and dyeing units creates economies of scale that lower costs and boost margins for investors. Meanwhile, the textile export market, which accounts for a significant share of India’s foreign earnings and spans apparel, home textiles, and technical fabrics provides a steady stream of foreign‑currency revenue, making Indian firms attractive to global funds seeking diversification. Growing demand for sustainable textile production, eco‑friendly processes, recycled fibers, and low‑water dyeing techniques opens niche investment opportunities, as brands and consumers alike push for greener supply chains. Investing in Indian textiles therefore requires evaluating three semantic triples: the sector encompasses the industry, the industry relies on key hubs like Surat, and the hub fuels export growth; sustainable practices influence market pricing; and export dynamics shape capital returns.

For a practical angle, consider how capital can be deployed across the value chain. Equity stakes in large integrated manufacturers give exposure to scale efficiencies, while minority positions in niche sustainable fabric start‑ups tap into premium pricing trends. Debt financing for modernizing dye‑houses or installing water‑recycling plants can earn covenant‑protected returns with a social impact angle. Real‑estate funds targeting warehouse and logistics parks near Surat capture the logistics premium as global buyers look for faster shipping times. Finally, commodity‑linked instruments tied to cotton or synthetic fiber prices let investors hedge raw‑material risk while staying linked to the sector’s fundamentals. All these options reflect the same core reality: a deep‑rooted, diversified ecosystem where each piece—production, hub, export, sustainability—interacts to create value. Below you’ll find articles that break down these components, from Surat’s competitive edge to the latest sustainable fiber innovations, giving you the context needed to make informed decisions.

Thinking about launching a textile mill in India? Learn about revenue potential, risks, local challenges, and real costs. Deep dive into India's ever-growing textile industry. (Read More)