Picture this—the richest chemical company in the world pulls in tens of billions of dollars a year, shaping everything from basic plastics to advanced pharma ingredients. This isn’t just about big money. It’s about global reach, innovation, and having a finger in every major industrial pie. Curious how they do it?

If you’re running a chemical business in India or just thinking about entering the field, it pays to know who’s leading the pack. The world’s top chemical players aren’t just pushing barrels and bags—they’re building research labs, snapping up patents, and forging deals from Shanghai to Sao Paulo. Watching these giants can give you a roadmap for success, show you where the industry is heading, and maybe even spark an idea you can use right here.

- Who Tops the List: The Global Chemical Giant

- By the Numbers: Revenue and Reach

- What Makes Them So Successful

- Where Indian Chemical Firms Stand

- Lessons for Indian Manufacturers

- What’s Next for the Industry

Who Tops the List: The Global Chemical Giant

If you’re wondering who sits on the chemical industry’s money throne, it’s BASF. This German company is the world’s richest chemical company by revenue and scale. To give you some context, BASF snagged a whopping 68.9 billion euros (about $76 billion) in sales in 2024. That’s more than the GDP of some countries. Not only that, they have over 111,000 employees worldwide and do business in nearly every country you can think of.

BASF isn’t just a local hero either. Their reach covers chemicals, plastics, performance products, agricultural solutions, and oil and gas. Their client list includes everything from big car companies to food producers—so BASF touches your life whether you’re driving, eating, or even cleaning your house.

| Company | Country | Revenue (2024, USD) | Employees |

|---|---|---|---|

| BASF | Germany | $76B | 111,000+ |

| Sinopec | China | $61B | 70,000+ |

| Dow | USA | $47B | 37,000+ |

| Sabic | Saudi Arabia | $43B | 31,000+ |

What really gives BASF the edge? They put out tons of new products every year, and have over 1,000 patents to their name. Their focus on sustainability is also paying off—cleaner tech, fewer emissions, and lots of investment in recycling. If you’re looking for a model of what a truly global and innovative chemical company looks like, BASF sets the standard. Keep this name in mind if you're serious about learning from the best in the chemical world.

By the Numbers: Revenue and Reach

BASF takes the crown as the richest chemical company in the world. This German powerhouse made about $74 billion (roughly ₹6.1 lakh crore) in revenue in 2024. That’s more than double the size of most Indian chemical giants put together. BASF isn’t just big in Europe—they’ve got operations everywhere: the U.S., China, India, Brazil, and more.

To give you a quick picture of how they compare with other global leaders, check out the numbers below:

| Company | 2024 Revenue (USD Billion) | Countries Present |

|---|---|---|

| BASF (Germany) | 74 | 90+ |

| Sinopec (China) | 68 | 30+ |

| Dow (USA) | 57 | 160+ |

| SABIC (Saudi Arabia) | 48 | 50+ |

| LG Chem (South Korea) | 37 | 20+ |

BASF serves nearly every big market on the planet. India, for example, is a key part of their growth, with over 3,000 employees and several major manufacturing units. They supply chemicals to just about every sector—agriculture, cars, medicines, and home goods. Their worldwide presence keeps them less vulnerable to problems in any one region.

Here’s why their massive reach matters to Indian chemical manufacturers:

- They have localized plants and R&D centers, so they can quickly adapt products for different markets.

- Diversifying across so many countries protects them from political or business risks in any one place.

- By spreading out operations, they pick up new ideas, tech, and talent from all over.

When you stack up revenue and reach, BASF is in a league of its own. Their size allows them to weather slowdowns, cut deals with the world’s biggest companies, and invest more in innovation than most competitors—even the major Indian players. That’s what sets the bar high for everyone else.

What Makes Them So Successful

So, what’s the secret sauce for the world’s richest chemical company? It’s not luck. The German giant BASF usually tops the list, with annual revenues around $90 billion (as of 2024) and plants scattered across every continent. Their game plan isn’t just about volume—it’s about smart thinking, relentless R&D, and not being afraid to take risks.

First, let’s talk research. BASF pours over $2 billion a year into R&D, which keeps them ahead in everything—from crop chemicals to battery materials. That lets them launch new products faster than smaller rivals can even react. As Dr. Martin Brudermüller, BASF’s CEO, put it:

"Innovation is at the heart of BASF’s strategy. We try to solve real problems for our customers, not just deliver chemicals."

Another key to their success is a global footprint. With production plants in over 90 countries, BASF dodges supply bottlenecks and keeps shipping times short—no matter where their buyers are. They tailor products to local markets, so a solution that works in Germany might be totally different from what sells in India.

Then there’s integration. BASF has what they call ‘Verbund’—an interconnected network of factories where the waste from one process becomes raw material for another. This cuts costs and slashes emissions, making the business both lean and green. It’s one of those simple ideas that’s surprisingly hard to copy.

Want a peek at how all this stacks up? Check out these numbers:

| Metric | BASF Value (2024) |

|---|---|

| Annual Revenue (USD) | $90 billion |

| Global Employees | Over 112,000 |

| Countries with Production Sites | 90+ |

| Annual R&D Investment | $2.1 billion |

| New Patents Filed (2023) | Nearly 900 |

Here’s what puts them over the top:

- Huge R&D spending, leading to real innovation.

- Smart global supply chains that adapt fast.

- Strong focus on sustainability and efficiency.

- Deep relationships with big clients in auto, agriculture, and pharma.

So if you’re aiming to become the richest chemical company (or at least a stronger player), take notes from this playbook—think global, keep innovating, and tie your operations together for max efficiency.

Where Indian Chemical Firms Stand

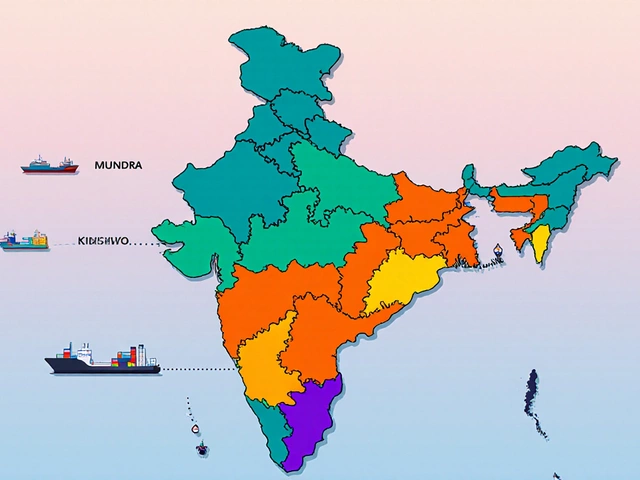

Indian chemical companies have carved out a solid spot in the global market, even if none of them have caught up to the massive revenue of BASF or Dow yet. India is actually the sixth-largest chemical producer in the world by sales, and the sector makes up about 7% of the country’s GDP. Exports are driving much of this growth—between April 2023 and March 2024, Indian chemical exports were valued at over $30 billion.

Check out how some major Indian chemical manufacturers measure up:

| Company | Revenue (USD Billion, FY2024) | Key Products | Global Reach |

|---|---|---|---|

| Reliance Industries (Petrochemicals) | ~65 | Polymers, Polyester, Elastomers | 50+ countries |

| UPL Ltd. | ~7 | Agrochemicals, Crop Protection | 130+ countries |

| Tata Chemicals | ~1.7 | Soda Ash, Bicarbonate, Speciality Chemicals | North America, Europe, Africa |

| Aarti Industries | ~0.9 | Specialty Chemicals, Pharmaceuticals | Global exports |

Reliance Industries leads among Indian players, though its full revenue isn’t only from chemicals. Still, its petrochemicals division alone dwarfs many local competitors and puts it on the global radar. UPL Ltd., on the other hand, is India’s largest pure-play agrochemical company and ranks in the top five worldwide for crop protection solutions.

Indian chemical manufacturers have a few big strengths. For one, costs are relatively low thanks to local raw materials and a giant workforce. Many companies also have the flexibility to pivot quickly to new and niche specialty chemicals, which are in higher demand these days. But there are challenges too—older infrastructure, heavy regulation, and tough global competition can slow things down.

Still, there’s momentum. Government initiatives like the PLI (Production-Linked Incentive) scheme are giving the industry a nudge. Investments in R&D, green chemistry, and tech upgrades are rising, and companies are starting to focus more on exports of high value-added products instead of just bulk chemicals. If Indian firms want to take a shot at becoming the richest chemical company someday, this push towards innovation and scale is non-negotiable.

Lessons for Indian Manufacturers

If you look at why the world’s richest chemical company—like Germany’s BASF—stays on top, a few patterns start popping up. One thing that’s crystal clear: They invest a ton in research and development. In 2023, BASF alone spent about €2.1 billion (roughly ₹19,000 crore) on R&D. That’s more than some Indian chemical firms make in total revenue. Innovation isn’t just a nice-to-have—it’s baked into their business.

Indian manufacturers can take a page from that playbook. Think about products with higher value-add rather than just basic chemicals. Specialty chemicals, for example, have a bigger profit margin and are less likely to be hit by price wars. The Indian chemical industry’s exports crossed $29 billion in 2023, mostly from bulk chemicals and agrochemicals. But if local companies push harder into specialty areas—like coatings, personal care ingredients, or pharma intermediates—there’s room for even bigger growth.

- Ramp up in-house R&D budgets and create partnerships with universities. This leads to smarter processes, greener tech, and new products customers actually want.

- Get serious about sustainability. Global buyers are starting to care where chemicals come from and how they’re made. Setting up zero liquid discharge plants or recycling units isn’t just good PR – it’s a sales pitch.

- Don’t underestimate branding and customer service. The richest chemical company doesn’t just sell what they make, they solve problems for their clients. Indian firms that offer technical support or custom formulations stand out fast.

- Keep an eye on regulatory changes—both in India and abroad. The top company actually helps shape the rules by being proactive, not waiting for the government to act first.

Here’s a quick look at how Indian chemical manufacturers stack up compared to the global leader:

| Metric | BASF (2023) | Largest Indian Firm (SRF Ltd., 2023) |

|---|---|---|

| Annual Revenue | €68.9 billion (~₹6.2 lakh crore) | ₹13,696 crore |

| R&D Spend | €2.1 billion (~₹19,000 crore) | ~₹405 crore |

| Product Segments | Over 6,000 | ~300 |

| Global Presence | 90+ countries | ~80 countries |

When you compare these numbers, the gap is pretty obvious, especially in R&D. But this also means there’s plenty of room to grow. The secret sauce that keeps chemical manufacturers India on the rise? Keep eyes open for new tech, listen closely to what global clients want, and don’t be afraid to go beyond ‘business as usual’.

What’s Next for the Industry

The chemical world isn’t staying the same. It’s moving fast, and the biggest shakeups are coming from tech, environment rules, and shifting demand. Whether you’re in India or watching the global scene, it’s clear that the future will look pretty different from what we see now.

One big trend — companies are going greener. Top firms like BASF (yes, still the richest chemical company), Dow, and Reliance are pumping huge budgets into cutting emissions and using more eco-friendly raw materials. By 2030, BASF wants to slash its greenhouse gas output by 25%. It’s not just talk. In 2024, global chemical companies spent about $35 billion worldwide on sustainability projects, and India’s Tata Chemicals joined the club by launching a major zero-liquid-discharge site last year.

Then there’s the tech side. You’ll see more automation, AI, and smart sensors in production plants. Indian manufacturers like Aarti Industries have started using AI for process optimization. According to the European Chemical Industry Council, almost 60% of large plants worldwide have at least one part of their line monitored by real-time data now. This leads to lower costs and fewer accidents—which directly boosts profits.

The industry is also shifting to serve newer markets. Electric vehicles, green packaging, and specialty chemicals for electronics are growing super fast. In 2025, specialty chemicals in India are expected to cross $40 billion in market value, driven by demand for things like semiconductors and battery materials.

| Trend | Example | Forecast / Fact |

|---|---|---|

| Green Manufacturing | BASF, Tata Chemicals | $35B spent globally in 2024 |

| AI & Automation | Aarti Industries | 60% of major plants use real-time data |

| Specialty Chemicals Demand | Indian firms ramping up | $40B market in India by end of 2025 |

If you’re looking to stay ahead, watch for changes in regulations and customer demands. The companies that invest now in cleaner production, quick innovation, and smart supply chains are going to lead the market—no matter where they’re based.