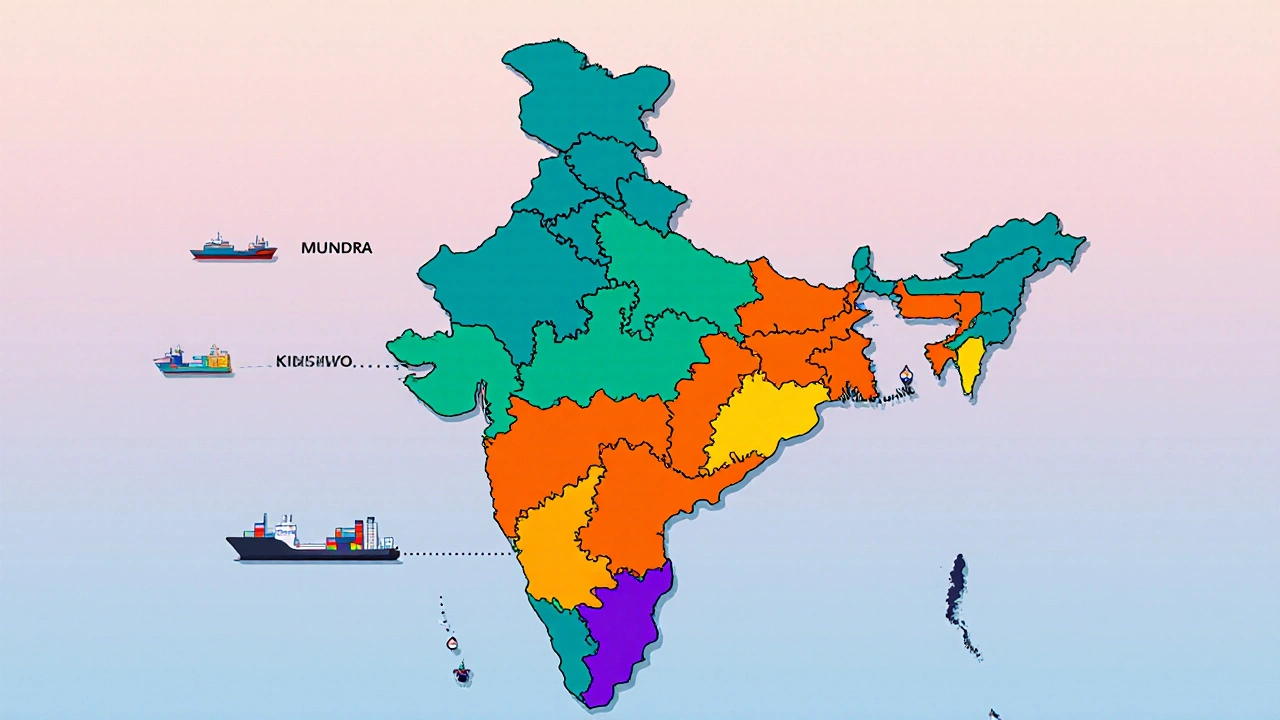

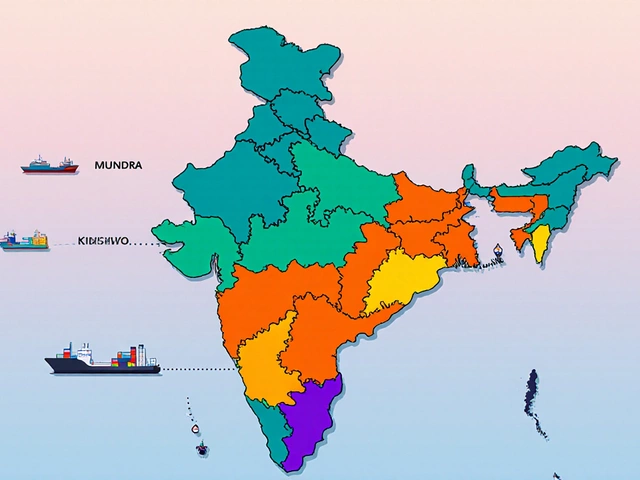

Top Indian Electronics Exporting States - 2023-24

Gujarat leads with 26% of India’s electronics export value at $6,500 million. The state’s strategic ports, SEZs, and strong policy support make it the top exporter.

Key advantages: Major SEZs (GIFT, Dahej), deep-water port at Mundra, tax incentives, and skilled labor force.

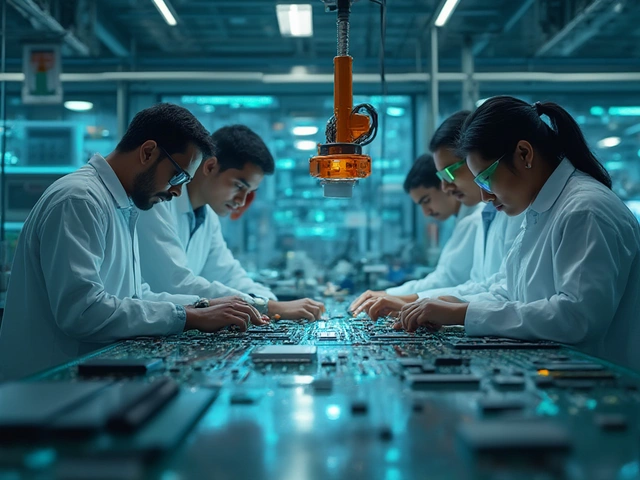

India’s electronics sector is now a global player, but not every state contributes equally. If you’re trying to figure out which state ships the most gadgets, phones, and components abroad, the answer hinges on a mix of policy, infrastructure, and home‑grown tech giants. Below we break down the latest numbers, spotlight the leading states, and explain why they dominate the export scene.

Key Takeaways

- Gujarat leads the pack, accounting for roughly 26% of India’s electronics export value in FY2023‑24.

- Maharashtra and Tamil Nadu follow, together delivering over 40% of the total export volume.

- Strong policy support from the Ministry of Commerce and Industry is a common thread among the top performers.

- Special Economic Zones (SEZs) and dedicated electronics clusters provide the logistical edge needed for large‑scale shipping.

- Emerging hubs like Andhra Pradesh and Haryana are poised to challenge the status quo in the next five years.

India’s Electronics Export Landscape

When we talk about India is a South Asian nation with a rapidly growing electronics manufacturing sector, the scale can be surprising. According to the latest data from the Ministry of Commerce, the country exported around India electronics export worth $25billion in the fiscal year 2023‑24, up 12% from the previous year. The growth is driven by mobile phones, consumer electronics, and increasingly, automotive electronics.

The export journey starts with design and assembly plants, moves through testing labs, and ends at ports like NhavaSheva and Chennai. Logistics, labor costs, and state‑level incentives shape the final numbers, making some states natural export powerhouses.

Top Exporting States (FY2023‑24)

| State | Export Value (USDmillion) | Share of Total (%) |

|---|---|---|

| Gujarat is a western state with major ports and SEZs | 6,500 | 26 |

| Maharashtra is home to Mumbai’s logistics hub and a large IT workforce | 5,800 | 23 |

| Tamil Nadu is known for its automotive electronics and coastal ports | 4,500 | 18 |

| Karnataka is the birthplace of many semiconductor design houses | 3,900 | 16 |

| Other States | 4,300 | 17 |

The table makes the hierarchy clear: Gujarat’s strategic ports and aggressive SEZ policy give it a decisive edge, while Maharashtra’s dense supply chain network keeps it close behind.

Why Gujarat Leads the Pack

Gujarat’s export dominance isn’t a happy accident. The state boasts the largest concentration of Special Economic Zones (SEZs) dedicated to electronics, such as the Gujarat International Finance Tec‑City (GIFT) and the Dahej SEZ. These zones offer tax holidays, simplified customs procedures, and ready‑made infrastructure.

Major players like Foxconn, Samsung, and Flex have set up massive assembly lines in the state, attracted by the combination of low land costs and a skilled labor pool trained at institutes like the Centre for Development of Advanced Computing (C‑DAC). The presence of a deep‑water port at Mundra allows containers to reach Europe or the US in under 30 days, a logistical advantage that directly boosts export volumes.

What Maharashtra Brings to the Table

Maharashtra’s strength lies in its logistics ecosystem. Mumbai’s port, the busiest in India, handles over 60% of the nation’s container traffic. Coupled with an extensive rail network, manufacturers can ship finished goods quickly and cost‑effectively.

The state also benefits from a large pool of engineers from institutes like the Indian Institute of Technology Bombay (IIT‑Bombay) and a thriving startup scene that feeds innovation into larger manufacturers. Companies such as Sony and LG run high‑volume production for smartphones and TVs, leveraging Maharashtra’s proximity to both the port and major supplier bases.

TamilNadu’s Coastal Advantage

Located on the southeastern coast, TamilNadu hosts the major port of Chennai, which specializes in handling bulk electronics cargo. The state's industrial corridors, especially the Sriperumbudur Electronics Hub, house OEMs like Apple’s iPhone assembly line, as well as numerous component manufacturers.

The government’s focus on ‘Make in India’ incentives, including subsidies for renewable‑energy‑powered factories, has lured firms that want to reduce operating costs while keeping export timelines short.

Karnataka’s Design‑First Approach

Karnataka, with Bengaluru as its capital, is often called the “Silicon Valley of India.” While the state isn’t as port‑centric as Gujarat or TamilNadu, it compensates with a robust design and R&D ecosystem. Companies like Intel, Texas Instruments, and Qualcomm have large design centres here, feeding advanced components to manufacturers across the country.

The presence of the Bengaluru International Airport’s cargo facilities also enables fast air freight for high‑value, low‑volume items such as semiconductor chips, allowing Karnataka exporters to command premium prices.

Key Drivers Behind High Export Volumes

- Policy Support: The Ministry of Commerce and Industry offers export incentives, duty drawback schemes, and streamlined customs clearance for electronics firms.

- Infrastructure: Deep‑water ports (Mundra, NhavaSheva, Chennai) and dedicated freight corridors cut transit times dramatically.

- Skill Availability: Technical institutes and vocational training programs feed a steady stream of skilled technicians and engineers.

- Cluster Effect: SEZs and dedicated electronics manufacturing clusters create supplier ecosystems that reduce lead times and costs.

- Market Access: Proximity to major Asian markets (China, Vietnam, Singapore) lets Indian exporters benefit from shorter shipping routes.

Emerging Players and Future Outlook

While the top four states dominate today, other regions are catching up. AndhraPradesh’s Kakinada SEZ has attracted smartphone component makers, and Haryana’s Gurugram area is seeing a surge in IoT device assembly due to its proximity to the NCR market.

By 2030, analysts predict that the share of Gujarat could dip slightly as Maharashtra invests in a new deep‑sea port at Alibag and TamilNadu expands its Krishnapatnam facility. However, the overall growth trajectory for Indian electronics exports is expected to stay above 10% annually, driven by global demand for 5G equipment, electric‑vehicle electronics, and renewable‑energy hardware.

How Businesses Can Leverage State Advantages

- Identify the state whose logistics align with your product’s weight and volume-use ports for bulk shipments, airports for high‑value chips.

- Take advantage of SEZ tax benefits by setting up assembly lines within designated zones.

- Partner with local training institutes to secure a pipeline of skilled workers, reducing recruitment delays.

- Monitor state‑level policy updates; many states issue annual electronics export incentives that can improve margins.

- Consider multi‑state operations: design in Karnataka, manufacturing in Gujarat, and export from Maharashtra to balance costs and speed.

Frequently Asked Questions

Which Indian state exported the highest value of electronics in 2023‑24?

Gujarat led the chart with approximately $6.5billion in electronics export value, representing about 26% of the country’s total.

Why are SEZs important for electronics exports?

SEZs provide tax holidays, simplified customs, and ready‑made infrastructure, which lower costs and speed up shipment processes-critical factors for high‑volume electronic goods.

Can a small‑scale electronics firm benefit from setting up in Gujarat?

Yes. Gujarat’s SEZs have tiered incentives that apply to firms of all sizes, and the state’s logistics network helps even small exporters reach global markets efficiently.

How does Maharashtra’s port infrastructure compare to Gujarat’s?

Mumbai’s port handles the highest container traffic in India, offering extensive connectivity. Gujarat’s Mundra port, however, provides deeper drafts and faster turnaround for mega‑container ships, giving it a slight edge for bulk electronics cargo.

What future trends could shift the export rankings?

The rise of electric‑vehicle electronics, 5G hardware, and renewable‑energy components will boost demand. States investing in dedicated EV‑electronics parks-like AndhraPradesh’s Kakinada SEZ-could climb the rankings in the next five years.