US Manufacturing, Steel, and Outsourcing – A Quick Guide

When talking about the United States, a federal republic in North America. Also known as USA, it hosts one of the world’s largest industrial economies, you instantly think of massive production capacity, global supply chains, and a workforce that powers everything from cars to smartphones. US manufacturing moves millions of tons of goods every day, fuels exports, and creates jobs across every state.

The manufacturing sector, the backbone of the American economy includes everything from aerospace to textiles. It demands a reliable supply chain, skilled labor, and constant innovation. In 2024, manufacturing accounted for about 11% of GDP and employed over 12 million workers. The sector’s health is tied to outsourcing decisions: companies shift parts of production abroad to cut costs, then bring them back when quality or speed suffer. That push‑pull creates a dynamic where reshoring becomes a strategic tool for competitiveness.

Turning to the steel industry, the historic engine of American heavy manufacturing, we see a story of rise, decline, and renewal. Pittsburgh earned the nickname "Steel City" because its mills once supplied half the nation’s steel. Today, the U.S. still produces roughly 70 million metric tons of steel annually, with modern plants focused on specialty alloys and high‑strength applications. The industry now leans on advanced technology and domestic sourcing to stay competitive against cheaper imports.

Detroit offers a clear example of how regional hubs shape national production. Once the epicenter of automobile assembly, Detroit still hosts dozens of factories that churn out cars, trucks, and components. The city's auto ecosystem links directly to both manufacturing and steel—vehicle frames need high‑grade steel, while parts often travel through global outsource networks before returning for final assembly. Recent data shows that about 30% of U.S. auto parts are sourced overseas, but a growing reshoring trend aims to bring more of that work back to the Motor City.

Local manufacturing brings tangible benefits beyond headline numbers. Communities around factories see higher wages, new training programs, and stronger tax bases. When a plant adopts greener processes, nearby residents enjoy cleaner air and water. At the same time, firms that rely on imported components must manage risks like shipping delays, tariff changes, and quality control issues. Balancing these forces—domestic production, offshore sourcing, and regional specialization—defines the modern U.S. industrial landscape.

Below, you’ll find a curated set of articles that dive deeper into each of these themes. From the supply chain behind IKEA’s furniture to the role of Indian pharma in the U.S. market, the collection covers real‑world examples, data‑driven insights, and actionable takeaways. Browse on to see how global trends intersect with American manufacturing, steel, and outsourcing dynamics.

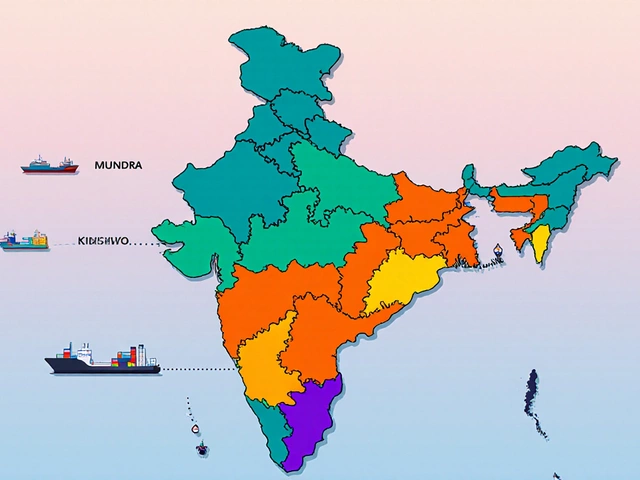

The United States, being a leading economy, imports a significant portion of its machinery from various global suppliers. Among these, India stands out as a prominent contributor to the US machinery market. This article delves into the factors that make Indian manufacturers critical providers, highlights the prominent companies involved, and explores the potential growth areas in this sector. With robust manufacturing capabilities and competitive pricing, India's role in supplying machinery to the US continues to grow. (Read More)