Ford exit: Understanding Why Car Makers Leave Markets

When talking about Ford exit, the process where Ford pulls out of a geographic market or shuts down a plant, you’re really looking at a slice of the automobile industry, the global network of vehicle designers, manufacturers, suppliers, and dealers. A market withdrawal, the decision to stop selling or producing in a specific region often triggers a plant closure, the shutdown of a manufacturing facility and the layoff of its workforce. These three pieces fit together: a Ford exit involves a market withdrawal, which can lead to a plant closure, and the ripple effects reshape the broader automobile industry.

Ford exit isn’t just a headline; it’s a strategic move that reflects financial pressure, regulatory changes, or a shift toward new technologies. When sales dip below the break‑even point, keeping a factory running costs more than the revenue it brings in. Add tighter emissions rules, rising labor costs, or a consumer tilt toward electric vehicles, and the math quickly turns unfavorable. Companies like Ford then evaluate whether to double down on investment or pull back and reallocate resources to more promising markets.

Key drivers behind a Ford exit

First, demand erosion is a classic trigger. If a region consistently sells fewer cars than projected, the profit margin collapses. Second, policy pressure can make local production too expensive; stricter fuel‑efficiency standards or heavy tariffs raise the cost of doing business. Third, the rise of electric mobility forces legacy automakers to redesign factories, and the capital needed for new EV lines can be prohibitive in markets where the EV rollout is still slow. Finally, competitive dynamics matter—a surge of low‑cost rivals can squeeze Ford’s market share, prompting a pull‑back.

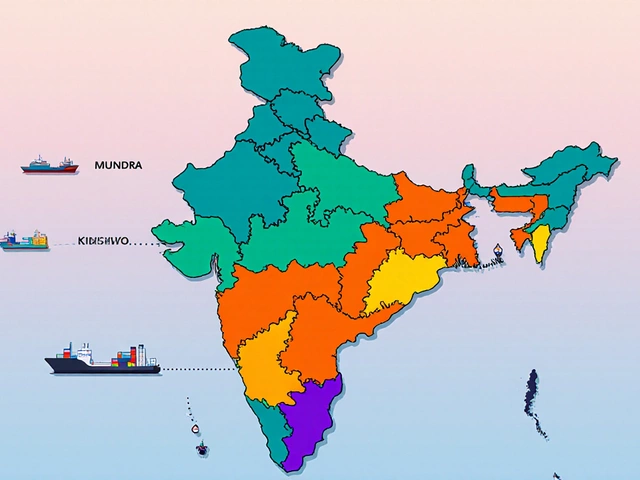

Case in point: Ford’s decision to leave South America a few years back stemmed from a mix of weak demand, currency volatility, and a strategic pivot toward North American and European EV investments. The move led to a plant shutdown in Brazil, affecting thousands of workers and a network of local suppliers. Similar patterns appeared when other giants like General Motors trimmed operations in Europe, showing how market withdrawal and plant closure often travel hand‑in‑hand.

Beyond the headline numbers, a Ford exit reshapes local economies. Job losses are the most visible impact, but the supply chain feels the shock too. Parts manufacturers, logistics firms, and even local service shops see reduced orders. Some regions respond with government incentives to attract new manufacturers or retrain displaced workers, turning a negative into a chance for diversification.

From a corporate perspective, exiting a market can free up cash to fund growth elsewhere. Ford, for instance, redirected funds from its South American exit into electric‑vehicle R&D in the United States, accelerating its EV roadmap. That reallocation illustrates the trade‑off: short‑term pain for long‑term strategic gain. Companies often announce a “restructuring plan” that outlines how they’ll support affected employees, manage asset sales, and invest in future‑proof technologies.

Strategically, a well‑executed exit includes three steps: (1) transparent communication with stakeholders, (2) clear timelines for plant shutdown and asset divestiture, and (3) investment in transition programs for the workforce. When these steps are followed, the broader automotive ecosystem can adapt more smoothly, and the brand retains goodwill for possible re‑entry when market conditions improve.

Looking ahead, the frequency of Ford exits may rise as the industry accelerates toward electrification and autonomous driving. Regions that lag in EV adoption or lack supportive policies could become candidates for withdrawal, while markets offering strong incentives might attract new factories. Keeping an eye on these trends helps suppliers, investors, and policymakers anticipate the next wave of reshaping.

Below you’ll find a curated set of articles that dig deeper into related topics—automotive market shifts, manufacturing challenges, and the broader impact of industry exits. Each piece adds a layer of insight to help you grasp the full picture of why a Ford exit happens and what it means for the future of mobility.

Rumors about Ford leaving India have caused a lot of worry among car owners and buyers. This article digs into what’s really happening with Ford’s operations in India, based on the latest news as of June 2025. Find out how this affects service, spare parts, warranties, and resale value if you drive a Ford or plan to buy one. We’ll break down Ford’s past moves in India, why things have changed, and what you can expect next. Whether you’re a long-time Ford fan or just curious about the car market, this guide explains the most important facts in plain English. (Read More)