India Economy: Manufacturing, Exports, and Growth Insights

When you explore India's economy, the aggregate of production, consumption, and trade that drives the nation’s financial health. Also called Indian economic system, it determines jobs, income levels, and regional development. Understanding the India economy means looking at the forces that push GDP upward and the challenges that pull it down.

Key Pillars of the India Economy

The first pillar is the manufacturing sector, industries that turn raw materials into finished products ranging from textiles to electronics. In 2024 it contributed roughly 17% of GDP and employed over 120 million workers. Cities like Pune, Chennai and Surat host clusters that attract foreign direct investment, improve skill levels, and generate tax revenue. This sector not only creates jobs but also fuels the second pillar – exports, the sale of domestically made goods to overseas markets. Together they form a clear chain: the manufacturing sector produces goods, exports send those goods abroad, and export earnings feed back into the economy, boosting GDP and funding new factories.

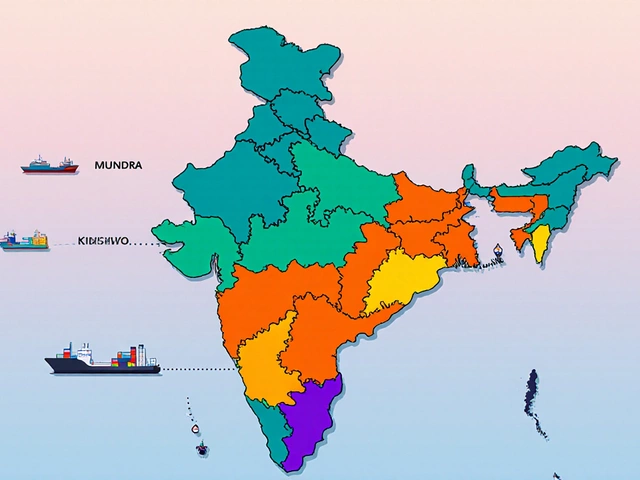

Exports have become a strategic lever for growth. In 2023‑24 India shipped about $450 billion worth of goods, with electronics, pharmaceuticals and textiles leading the pack. Gujarat, Maharashtra and Tamil Nadu together accounted for more than half of that value, thanks to well‑developed ports and logistics ecosystems. Trade agreements such as the RCEP and renewed focus on “Make in India” policies have eased market access, while tariff reductions have made Indian products more price‑competitive. The result is a virtuous cycle: higher export volumes improve the trade balance, attract more production capacity, and create a ripple effect across ancillary services like freight, finance, and warehousing.

Another critical component is the pharmaceutical industry, the network of companies that develop and produce medicines for domestic and global markets. With firms like Cipla, Sun Pharma and Dr. Reddy’s supplying generics to over 150 countries, the sector now accounts for roughly 7% of national GDP. It not only brings in export revenue but also supports public health, which in turn raises labor productivity. The industry's rapid adoption of advanced manufacturing techniques—continuous processing, AI‑driven formulation, and biotech labs—has lowered production costs and opened new markets for biosimilars and vaccines, reinforcing its role as a growth engine.

The textile industry, the sector that designs, manufactures, and exports fabrics and garments remains a backbone of regional development, especially in Surat, which now hosts over 2 million workers and contributes more than 30% of India’s textile export share. Investments in modern looms, sustainable dyeing processes, and digital design platforms have boosted productivity while cutting environmental impact. The sector benefits from strong domestic demand for apparel, rising export orders from the US and EU, and government schemes that subsidize capital equipment. As a result, textile makers can reinvest earnings into R&D, expand into technical textiles, and create higher‑value jobs, feeding back into the broader economy.

Below you’ll find a curated set of articles that dig into each of these areas—details on IKEA’s Indian suppliers, the rise of Cipla, Surat’s textile dominance, the latest export rankings, and more. Whether you’re a business owner, policy watcher, or curious reader, the pieces ahead break down the data, trends, and real‑world examples shaping the India economy today.

Indian manufacturing, especially in the chemical sector, keeps hitting roadblocks despite big promises. Simple problems—like tricky regulations, high costs, and shaky infrastructure—hold businesses back. Chemical manufacturers face extra headaches with raw material imports and unpredictable policies. This article breaks down what’s really stopping growth, and shares tips for companies to survive in this tough scene. No jargon, just practical facts and advice. (Read More)