Profit Margin: Key Insights for Better Business Profits

When evaluating profit margin, the ratio of net income to total sales that shows how much money a company keeps after covering its costs, businesses get a clear signal of financial health. gross margin, the share of revenue left after deducting the cost of goods sold tells you how efficiently production runs, while net margin, the bottom‑line percentage after all expenses, taxes, and interest reflects the ultimate profitability. A solid pricing strategy, the plan for setting product prices to balance demand and cost recovery directly shapes these margins. Understanding how these concepts interact helps you spot levers for improvement.

Profit margin isn’t just a number; it’s a decision‑making tool. When a manufacturer trims waste, the cost of goods sold drops, pushing gross margin up. That higher gross margin then feeds into net margin, assuming overhead stays stable. In other words, gross margin influences net margin (semantic triple). Companies that sync pricing strategy with real‑time cost data often see a faster climb in profit margin (semantic triple). For small‑business owners, watching this chain lets you know whether a price hike will actually boost the bottom line or just inflate revenue without profit (semantic triple).

Why Profit Margin Matters Across Sectors

In the Indian textile hub of Surat, producers compare unit cost versus selling price to keep gross margin healthy, which in turn protects net margin against volatile raw‑material prices. In electronics manufacturing hubs like Gujarat, the same principle applies but the focus shifts to technology‑driven cost reductions that lift both margins simultaneously. The pharmaceutical sector, exemplified by giants like Cipla and Sun Pharma, leans heavily on net margin analysis to gauge the impact of research spend and regulatory fees. Each of these examples shows how profit margin acts as a universal yardstick, no matter the industry.

Another layer is the cost structure. Fixed costs—factory rent, equipment depreciation, salaried staff—remain steady, so a higher profit margin often means you’ve successfully turned variable costs into a smaller slice of revenue. Variable costs, such as raw material or component imports, swing with market conditions. When a company improves its supply‑chain efficiency, the lowered variable cost lifts gross margin first, then net margin follows (semantic triple). That cascade is why many of our articles focus on supply‑chain resilience, local manufacturing benefits, and reshoring trends.

For entrepreneurs scouting the most profitable small‑business ideas in 2025, profit margin is the primary filter. Ventures with a net margin above 15 % tend to survive economic downturns better than those hovering around 5 %. The data‑driven approach we showcase—calculating expected gross margin, adjusting pricing strategy, and projecting net margin—helps you spot ideas that combine low startup cost with high upside. Our guide on “Most Profitable Small Business Ideas” walks you through that exact process.

Profit margin also interacts with growth strategy. Companies chasing rapid expansion often accept a lower net margin temporarily, betting that scale will bring down unit costs and eventually boost both gross and net margins. This trade‑off is a classic scenario we explore in articles about manufacturing scaling, capital investment, and market entry. Recognizing the margin impact of each growth move lets you plan smarter.

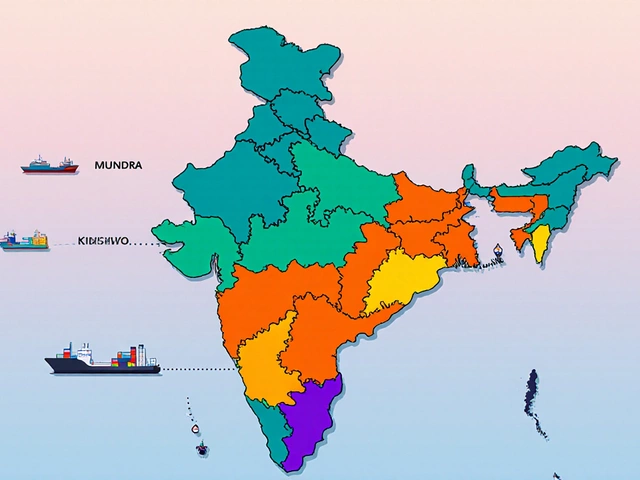

When you compare profit margin across regions, you’ll notice geographic patterns. Indian states like Maharashtra and Tamil Nadu show higher average profit margins in electronics exports because of better logistics and skilled labor pools. In contrast, states with higher tax rates or less developed infrastructure may see narrowed margins, prompting businesses to consider relocation or outsourcing. Our post “Top Indian State for Electronics Exports – 2025 Data” dives into those numbers.

Environmental sustainability is another factor reshaping profit margins. Companies that adopt energy‑efficient processes often reduce utility costs, lifting gross margin without raising prices. The resulting net margin improvement can be a competitive advantage, especially when customers value green manufacturing. This link between sustainability initiatives and profit margin is highlighted in our sustainability‑focused pieces.

Finally, remember that profit margin is a snapshot, not a trend line. Regularly monitoring month‑over‑month changes reveals early warning signs—like rising overhead eating into net margin or a dip in gross margin due to supplier price hikes. Armed with that insight, you can act before a small issue becomes a major profit hit.

Below you’ll find a hand‑picked collection of articles that break down each of these angles: from supply‑chain dynamics and state‑wise export performance to small‑business profit calculations and sustainability impacts. Dive in to see real‑world examples, data‑backed insights, and step‑by‑step guidance that will help you turn profit margin analysis into actionable strategy.

Curious about which small manufacturing business brings home the highest profit margin? This article breaks down the leading options, shares what makes them so lucrative, and explains what you actually need to get started. Expect real-world examples, cost-saving tips, and a practical look at what running these businesses is really like in 2025. Whether you're eyeing 3D printing, specialty foods, or custom crafts, you'll find advice you can use. Make your money—and time—work smarter, not harder. (Read More)