If you swallow a simple painkiller in the States these days, there’s a serious chance the pill was made half a world away in India. It’s not just the odd bottle of generic ibuprofen—a full-scale pharmaceutical revolution has unfolded in just a few decades, and most Americans don’t even realize it. Indian drug makers now produce a staggering portion of the generic medicines filling US pharmacy shelves. And this didn’t happen quietly. Fierce price competition, global recalls, persistent regulatory drama; these companies are as visible in Wall Street reports as they are in the endless lists of FDA-approved generics. So, which Indian pharmaceutical companies have actually made it big in the US?

Why Indian Pharmaceuticals Have Conquered the US Market

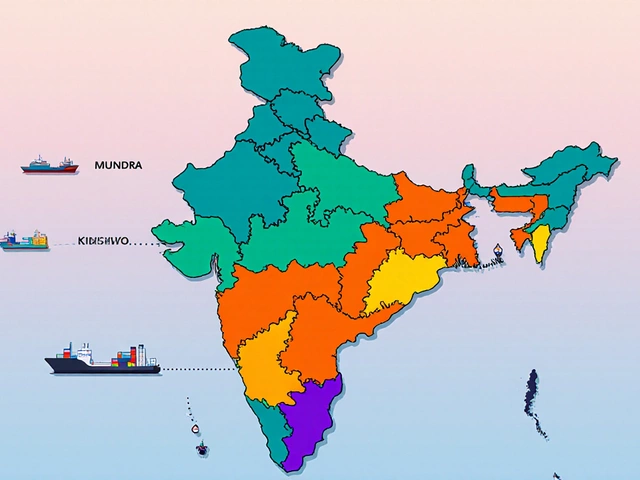

It almost feels like an underdog sports story—the rise of Indian pharmaceutical companies in the US. Back in the 1980s, India changed its patent laws to encourage cheap, non-branded medicines, and the country turned into a powerhouse for generics almost overnight. Fast forward to 2025 and India accounts for about 40% of all generic medicines used by Americans, according to the US FDA. If you walk into any American pharmacy, you’ll see the fingerprints of Indian pharma giants literally everywhere—from basic statins and antibiotics to cancer meds and anti-retrovirals. The US market loves generics; when blockbuster drugs lose their patents, Indian firms swoop in with lower-priced alternatives, and this keeps US medical costs down for everyone.

The US is no easy playground, though. The FDA—America’s food and drug watchdog—has strict rules that even local players sometimes struggle with. Indian firms had to up their game fast, investing in state-of-the-art manufacturing, quality control, and regulatory expertise. A decade ago, several of these companies found themselves slapped with "warning letters" over facility issues or data errors. So, why weren’t they chased out? Simple: the US simply can’t afford to lose this supply chain, especially after shortages highlighted by the COVID-19 pandemic. In fact, some American hospitals rely on Indian-made generics for up to 90% of their daily medicine supply!

What makes Indian companies so dominant? A few key reasons: world-class chemistry talent, the sheer scale of their operations, and cost advantages that just can’t be matched in the US or Europe. Manufacturing medicines in India can cost 60–80% less than in Western nations. And thanks to FDA inspections on Indian soil and joint ventures with US firms, Indian pharma players are now hitting even stricter quality standards than before.

The Indian Pharma Players Who Run the Show in America

Wonder who brings all those medicines to America from India? Here are the juggernauts—and a splash of newcomers—who’ve built sprawling empires across US states.

Sun Pharmaceutical Industries sticks out as the world’s fourth-largest specialty generics company. Headquartered in Mumbai, Sun Pharma made major waves by acquiring Ranbaxy (another Indian legend) in 2014. Today, Sun Pharma supplies a dizzying array of products across neurology, cardiology, oncology, and dermatology. The company owns key manufacturing sites in the US and has scored over 500 ANDAs (abbreviated new drug applications) with the FDA. That’s a fancy way of saying they make hundreds of different generic drugs Americans regularly count on.

Then comes Dr. Reddy’s Laboratories. Based in Hyderabad, Dr. Reddy’s is basically a household name for anyone working in pharma. Their generics division alone offers more than 140 products in the US, covering pretty much everything from over-the-counter allergy pills to complex chemotherapy injectables. They’re big on biosimilars and have built partnerships with global brands—no small feat in a cutthroat market like America’s.

Let’s not ignore Lupin Limited. This Mumbai-based firm has more than 70 FDA-approved products selling in the US. Famous for its leadership in cardiovascular, diabetes, and asthma treatments, Lupin works directly with American hospitals and clinics, actually solving supply chain headaches during drug shortages. When a vital diabetes drug became scarce in the US in 2023, Lupin’s swift ramp-up kept shelves stocked and costs reasonable.

Cipla Ltd. might ring a bell; they’ve been making waves in the US since the early 1990s. Cipla churns out both generic drugs and active pharmaceutical ingredients (the building blocks). They’re aggressive acquirers too; their buyout of Invagen Pharmaceuticals gave them deeper access into the American market. Cipla’s US subsidiary now lists over 180 generic approvals—think HIV, asthma inhalers, and even specialized hospital injectables.

Another heavyweight, Aurobindo Pharma, is a constant on the FDA’s top generics list. They’ve scaled up over 250 approved products in the US—one of the highest for any Indian company. Aurobindo does it all: tablets, capsules, liquids, ointments, you name it. The firm operates large US manufacturing facilities, and their products pop up everywhere—from Walmart’s pharmacy aisles to mail-order prescription services like Express Scripts.

Glenmark Pharmaceuticals is smaller but scrappy. They made a name with allergy, respiratory, and pain relief meds, winning FDA green lights for over 80 products in the States. Glenmark’s US business is built on speed and specialty, often launching generics on Day One after a big brand medicine loses its patent—a serious business coup in the generic drug world.

Others worth mentioning include Zydus Lifesciences (previously Zydus Cadila), Torrent Pharmaceuticals, Alkem Laboratories, Strides Pharma, and Biocon (especially in biosimilars). Every one of these companies holds dozens, sometimes hundreds, of product approvals. Biocon, for example, is now breaking ground in insulin and biosimilar launches, hoping to disrupt diabetes care in America as it did with cancer drugs globally.

The Real Impact of Indian Companies on US Healthcare

What does all this mean for the average American patient? For one, medical bills are way cheaper than they would be without Indian generics. It’s not rare for a brand-name drug to cost ten times—or even a hundred times—more than its generic equivalent. Indian pharma not only supplies the pills but also keeps US companies honest in their pricing, thanks to fierce competition. In fact, according to the Association for Accessible Medicines, generic drugs (many of them Indian-made) saved the US over $373 billion in 2024 alone.

But price is just one side of it. Drug shortages are a big deal in the States—think children’s antibiotics during a bad flu season or critical hypertension meds in hospitals. Indian companies have filled these gaps, sometimes taking emergency orders and switching around production lines in a matter of weeks. When Hurricane Maria knocked out manufacturing in Puerto Rico in 2017, Indian pharma shipments were among the first to stabilize US hospital supplies.

Another twist: Indian drug makers are trailblazing into advanced medicines, not just simple pills. Take biosimilars—drugs that mimic complex biologic medicines like Humira or insulin. These used to be the exclusive turf of US and European behemoths. Now, Indian firms like Biocon and Dr. Reddy’s hold FDA licenses for cutting-edge biosimilars, shaking up a $60-billion-a-year market and giving American patients more treatment options at lower costs.

It’s not all easy winnings, though. These giants have had to fix quality issues—like poor documentation, inconsistent batch results, or gaps in GMP (Good Manufacturing Practice) compliance. The FDA’s remote audits during COVID made things tricky but didn’t let anyone off the hook. Indian pharma responded with digital record-keeping, live video inspections, and a flood of investment in automation. The result? Today’s generics from India are cleaner, safer, and trackable all the way back to their origin plant.

Public trust is hard-won. A single contaminated batch can lead to tough headlines, recalls, or bans. But the numbers speak for themselves: Indian firms are not just surviving, they’re thriving on reputation, supplying everything from birth control to oncology meds without missing a beat.

Challenges, Controversies, and the Road Ahead

No success story comes without speed bumps—and Indian pharma in the US is no exception. Regulatory pressure is constant. The FDA’s warning letters and import bans still grab headlines every year, especially when a company slips on data integrity or cleaning protocols. The relentless scrutiny has forced Indian executives to think globally, invest billions in modernization, and hire American leadership for local know-how.

Another concern: geopolitics. With US-China relations always on edge, American policy makers have started looking at India as a "friend-shoring" option—a safer bet compared to China for medicine manufacturing. But this cozy relationship means Indian companies are expected to meet ever-higher standards, respond quickly to shortages, and survive price pressures that squeeze profit margins razor-thin.

Price battles can get bloody. After blockbuster brands lose their patents, there’s a race to launch the first generic—known as the “Paragraph IV” battle. Indian companies fight tooth-and-nail for this window, but the more generics that enter, the steeper the price cut. In some cases, prices get so low that a few smaller suppliers quit the US market altogether. Sun Pharma and Dr. Reddy’s solve this by focusing on difficult-to-make drugs or venturing into controlled substances, injectables, or specialty therapies where margins are higher.

Then there’s the issue of “Buy American” rhetoric in US policy. Some US lawmakers push for homegrown drug manufacturing, especially after pandemic shortages. While a few new plants are popping up in the States, the US simply can’t match India’s chemistry workforce or scale overnight. Most likely, we’ll see more partnerships—Indian pharma investing in US facilities, and American hospitals locking in long-term contracts with their Indian suppliers.

With patents on even more blockbuster medicines set to expire soon, Indian companies are revving up research into complex generics, smart drug delivery, and custom biosimilars. It’s an arms race, not just in volume, but in science and safety. Training, digitalization, and transparency are the new buzzwords in boardrooms from Mumbai to New Jersey, with virtual audits and paperless labs becoming the norm. The race is less about producing a million pills, and more about launching the most sophisticated, safe, and timely medicines imaginable.

So, next time you pop a generic allergy tablet or fill a prescription for blood pressure meds, think about the global journey that tiny pill has made. Odds are, an Indian scientist, factory worker, and regulatory expert all played a part. The US market is demanding, complicated, and never dull—exactly the kind of stage where Indian pharmaceutical companies thrive and evolve.