Manufacturing Startup Cost Estimator

Estimated Startup Costs

Total Estimated Cost:

Breakdown:

Cost Components Breakdown

Fixed Assets

- Equipment & Machinery

- Factory Premises

- Initial Inventory

Operating Expenses

- Legal & Registration Fees

- Working Capital

- Training & Setup Costs

Dreaming of running your own factory but not sure where to start? Turning that vision into a real manufacturing company is tougher than just buying machines - you need a solid plan, the right paperwork, funding, and compliance. Below is a practical roadmap that walks you through every major milestone, from legal registration to cracking open the doors of your first production line.

Key Takeaways

- Register the business with ASIC and secure an ABN within a week.

- Identify the optimal industrial zone before signing a lease.

- Map out financing - bank loans, government grants, or venture capital - and match them to your startup costs.

- Obtain WHS and environmental permits early to avoid costly delays.

- Build a lean staffing plan and set up SOPs before the first shift.

1. Define Your Manufacturing Niche

Before you fill out any forms, decide what you will actually make. Ask yourself:

- Is there a market gap for this product?

- Do you have access to raw materials?

- Can you source or build the required equipment affordably?

For example, a small‑scale furniture maker in Sydney’s Western Suburbs can source reclaimed timber locally and tap into the eco‑friendly market trend.

2. Legal Foundations - Register Your Business

In Australia, the first official step is registering with the Australian Securities and Investments Commission (ASIC) - the regulator that handles company incorporation, business name registration and statutory reporting. Here’s a quick rundown:

- Choose a company structure - most manufacturers start as a proprietary limited (Pty Ltd) to limit personal liability.

- Check name availability on the ASIC register.

- File the online application (usually takes 1‑2 business days) and pay the AU$506 fee.

- Obtain an Australian Business Number (ABN) and register for GST if your turnover is expected to exceed AU$75,000.

While you’re at it, register for a Business Name with ASIC if you plan to trade under a name different from your company’s legal name. This protects your brand and makes invoicing easier.

3. Taxation and Payroll Setup

Next, head to the Australian Taxation Office (ATO) to register for PAYG withholding, Superannuation Guarantee and any industry‑specific taxes. Set up accounting software that can handle inventory, cost of goods sold (COGS), and depreciation of factory assets.

4. Choose the Right Location

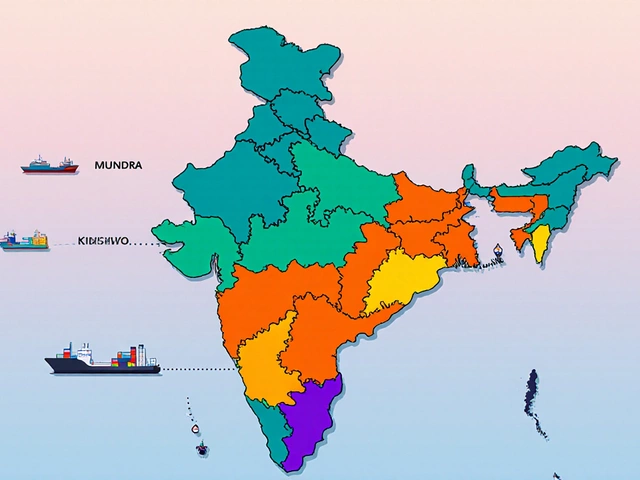

Location can make or break a manufacturing venture. Consider proximity to suppliers, transport links, labour pool, and zoning laws. Most new factories start in an industrial park - a designated area with ready‑made warehouses, power, and often shared logistics services. Key factors to compare:

- Lease cost per square metre

- Access to major highways or ports

- Local council incentives for job creation

In Sydney, the Western Sydney Business Park offers a 10‑year rent‑free period for qualifying manufacturers - a massive cash‑flow advantage.

5. Secure Funding

Manufacturing is capital‑intensive. Below is a quick comparison of the three most common financing routes for a startup factory.

| Option | Typical Amount | Eligibility | Pros | Cons |

|---|---|---|---|---|

| Bank Loan | AU$200k‑5M | Strong credit history, collateral | Predictable repayments, low interest | Lengthy approval, strict covenants |

| Government Grant | AU$50k‑2M (non‑repayable) | Innovation, job‑creation criteria | No debt, supportive services | Competitive, reporting requirements |

| Venture Capital | AU$1M‑10M+ | High‑growth potential, scalable model | Fast capital, strategic guidance | Equity dilution, exit pressure |

Start by preparing a five‑year financial model that shows cash flow, break‑even point and ROI. Use it to pitch to banks, apply for the Australian Government’s Manufacturing Modernisation Fund, or approach local angel networks.

6. Acquire Equipment and Set Up Production

Identify the core machinery you need and decide whether to buy new, rent, or use a lease‑to‑own model. For a small metal‑fabrication shop, essential equipment might include CNC routers, laser cutters, and a press brake.

When buying, request a detailed specification sheet that lists:

- Power requirements (kW)

- Footprint (sqm)

- Maintenance schedule

- Warranty period

Leasing can keep upfront costs low but be mindful of long‑term total cost of ownership.

7. Obtain Permits and Meet Compliance

Two regulatory bodies are crucial for every manufacturing plant:

- Work Health and Safety (WHS) authority - issues safety plans, risk assessments and required training for employees

- Environmental Protection Agency (EPA) - evaluates emissions, waste management and water usage, issuing environmental permits as needed

Start the application process early because both agencies may request site inspections, which can add weeks to your timeline.

8. Hire and Train Your First Team

Initially, keep staff numbers lean. Typical roles for a launch‑phase factory:

- Operations Manager - oversees daily production.

- Machine Technicians - maintain equipment.

- Quality Assurance Officer - ensures product standards.

- Warehouse/Logistics Coordinator - handles inbound materials and outbound shipments.

Invest in WHS training and a basic lean‑manufacturing course. A well‑trained crew reduces downtime and improves product consistency.

9. Launch Your First Production Run

Before the official launch, run a pilot batch to validate the workflow, test quality controls, and gauge customer response. Record key metrics such as:

- Cycle time per unit

- First‑pass yield (%)

- Energy consumption per unit

Use these numbers to fine‑tune SOPs and to build a compelling case for future investors.

10. Ongoing Growth Strategies

Once you’re shipping regularly, consider these levers for scaling:

- Automate repetitive tasks with robotics to cut labour costs.

- Expand product line based on market feedback.

- Leverage export incentives if you target overseas markets.

- Implement a continuous improvement program (Kaizen) to keep waste low.

Remember, the manufacturing landscape evolves quickly - staying agile is your biggest competitive edge.

Quick Checklist Before Opening Your Factory

- Choose company structure and register with ASIC.

- Obtain ABN, GST registration, and set up payroll with ATO.

- Select an industrial site that meets zoning and logistics needs.

- Secure financing and finalize a five‑year financial model.

- Purchase or lease equipment with clear specifications.

- Apply for WHS and EPA permits early.

- Hire core staff and deliver mandatory training.

- Run a pilot production batch and collect performance data.

- Launch marketing and sales channels.

Frequently Asked Questions

How much capital is needed to start a small manufacturing business in Australia?

The amount varies by industry, but a typical range is AU$200,000 to AU$1million. The lower end covers basic equipment, a modest lease and initial payroll, while the higher end includes automation and larger premises.

Do I need a special licence to manufacture goods?

Most manufacturing activities require a WHS safety permit and an environmental permit from the EPA. Specific products - such as food, chemicals or medical devices - may need additional licences from industry regulators.

Can I register a manufacturing company online?

Yes. ASIC’s online portal lets you incorporate a Pty Ltd company and register a business name in a single session. The whole process usually completes within 48hours.

What tax obligations do manufacturers have?

Manufacturers must lodge quarterly Business Activity Statements (BAS) for GST, PAYG withholding, and fuel tax credits. If you claim depreciation on plant and equipment, you’ll also file an annual tax return with the ATO.

How can I find government grants for new factories?

The Australian Government’s Department of Industry, Science and Resources publishes the Manufacturing Modernisation Fund and state‑based grant programs. Eligibility criteria usually focus on job creation, R&D, and sustainability outcomes.