How to Invest in TSMC: Steps, Risks, and Opportunities

When working with how to invest in TSMC, the process of buying shares in Taiwan Semiconductor Manufacturing Company, the world’s leading chip foundry. Also known as TSMC stock investment, it offers exposure to the fast‑growing semiconductor manufacturing sector. This activity connects directly to semiconductor manufacturing, the design and mass production of integrated circuits that power everything from smartphones to cars and the broader global electronics market, the worldwide demand for electronic devices and the components that run them. Understanding these links helps you see why TSMC is a unique investment case.

Taiwan Semiconductor Manufacturing Company dominates the advanced‑node arena, holding over 50% of the market for 7 nm and smaller processes. Its customers include Apple, Nvidia, and AMD, meaning any surge in demand for high‑performance chips instantly lifts TSMC’s revenue. The company’s fab capacity expansions in Taiwan and the United States illustrate a strategic push to satisfy the global electronics market’s appetite for next‑gen devices. In short, TSMC’s performance is a direct readout of semiconductor manufacturing health and the overall pace of tech adoption.

Key Considerations Before Buying

Investors need to grasp two core ideas: first, the link between TSMC’s fab utilization rates and the global electronics market’s growth; second, how stock market investing fundamentals apply to a foreign tech giant. High fab utilization often translates into stronger earnings, but it can also signal supply constraints that push pricing higher for customers. Likewise, the Taiwan tech industry, shaped by government policy and regional geopolitics, creates a backdrop that can swing the stock’s valuation independent of pure financial metrics.

From a stock market perspective, TSMC trades on the Taiwan Stock Exchange under the ticker 2330, and U.S. investors can access it via American Depositary Receipts (ADRs) under the ticker TSM. The ADR structure simplifies currency conversion and tax reporting, yet it adds a layer of payout timing differences. Knowing how ADRs work is crucial for any investor focused on how to invest in TSMC without getting caught off guard by settlement quirks.

Risk isn’t absent. Geopolitical tension between Taiwan and mainland China can spike volatility, while supply‑chain disruptions—like those seen during the COVID‑19 pandemic—can temporarily curb fab output. Valuation also matters: TSMC often trades at a premium relative to other semiconductor firms because of its cutting‑edge technology lead. Balancing these risks against potential upside requires a clear investment thesis.

Here’s a practical checklist to get you started: choose a brokerage that offers access to foreign ADRs, confirm that it supports fractional shares if you want to start small, and set up a watchlist for TSMC’s earnings calendar. Next, evaluate your risk tolerance; consider allocating no more than a modest percentage of your tech exposure to a single chip maker. Finally, decide whether you prefer a one‑time purchase or a dollar‑cost‑averaging strategy to smooth out price swings.

Diversification should be part of the plan. While TSMC offers pure‑play exposure to semiconductor manufacturing, pairing it with broader technology ETFs or other hardware‑related stocks can lower portfolio volatility. This approach acknowledges that the global electronics market is a network of interdependent players, and no single company can capture every trend.

Tax implications differ by jurisdiction. U.S. investors receive a 30% withholding tax on dividends from TSMC ADRs, which may be reduced to 10% if a tax treaty applies. Capital gains are taxed at the standard rate for U.S. securities, but keep an eye on any foreign‑tax credit you can claim to avoid double taxation. Consulting a tax professional is wise if you’re not familiar with cross‑border investment rules.

Staying informed is essential. Follow TSMC’s quarterly earnings releases, track fab capacity utilization, and monitor policy shifts in Taiwan’s semiconductor sector. Tools like Bloomberg, Reuters, and the company’s own investor relations portal provide real‑time data. Setting up alerts for major news—such as new fab announcements or shifts in the global electronics market—helps you react quickly.

All these pieces—semiconductor manufacturing fundamentals, the dynamics of the global electronics market, and solid stock‑market practices—come together to form a complete picture of how to invest in TSMC. Below you’ll find a curated collection of articles that dive deeper into each aspect, from supply‑chain analysis to step‑by‑step guides for buying ADRs. Use them as your roadmap to make an informed, confident investment decision.

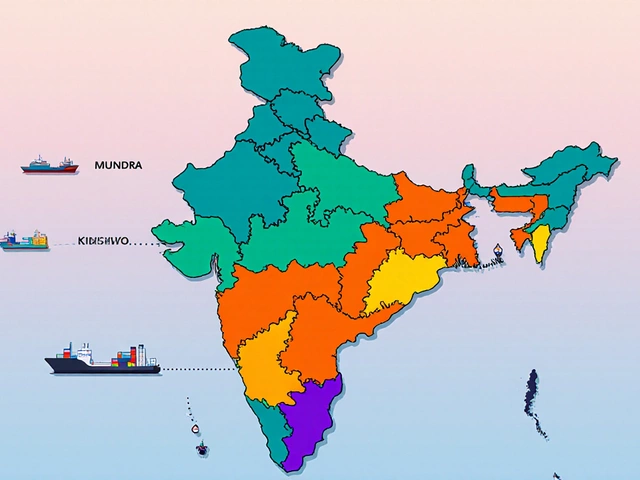

The semiconductor industry is immensely impacted by Taiwan Semiconductor Manufacturing Company (TSMC), a global leader in chip production. For Indian investors interested in capitalizing on this trend, the allure of investing in TSMC can be compelling. This article explores viable methods for Indian individuals to invest in TSMC, addresses regulatory hurdles, and highlights potential benefits and risks. Understanding these factors can empower investors to make informed decisions when venturing into international markets. (Read More)