JP Morgan: The Financial Engine Driving Manufacturing and Markets

When working with JP Morgan, a global leader in banking, investment and asset management. Also known as JPMorgan Chase, it provides the capital, research and risk tools that power large‑scale production and trade. Businesses from steel plants in Pittsburgh to textile mills in Surat rely on its credit lines and market insights to stay competitive.

One of the core services that links finance to factories is investment banking, advisory and capital‑raising work for corporations. Investment banking teams at JP Morgan help Indian manufacturers secure equity and debt, plan mergers, and launch new product lines. For example, a mid‑size auto parts supplier can tap a syndicated loan arranged by JP Morgan to upgrade its CNC machines, cutting lead times and boosting exports.

Beyond capital, asset management, the practice of growing client wealth through diversified portfolios plays a subtle but vital role. Institutional investors in JP Morgan’s funds often allocate capital to infrastructure projects that include logistics hubs and warehousing for Indian e‑commerce firms. Those funds indirectly improve supply‑chain reliability for manufacturers featured in our articles, such as the IKEA furniture network or the Indian pharmaceutical export pipeline.

Why JP Morgan Matters for Indian Manufacturing

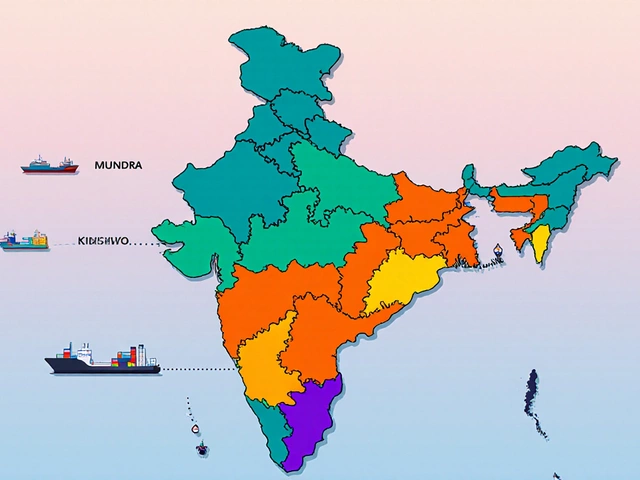

The connection between finance and factory floors becomes clearer when you look at JP Morgan’s research arm. Its quarterly industry reports on “global manufacturing trends” influence procurement decisions for companies ranging from textile producers in Surat to electronics exporters in Gujarat. The data points—like projected demand for high‑grade steel or the rise of low‑cost MDF—help plant managers choose the right material suppliers and plan capacity upgrades.

Another pillar is manufacturing financing, specialized credit products for production‑heavy businesses. JP Morgan structures term loans, revolving credit facilities and export‑linked financing that let Indian factories buy raw material in bulk, hedge currency risk, and meet international quality standards. When a new plant in Delhi seeks to import CNC‑controlled metal frames, JP Morgan’s trade finance solutions can slash payment delays and keep the assembly line moving.

All of these pieces—investment banking, asset management, research, and dedicated manufacturing financing—form a network that keeps the sector resilient. Readers will soon see how the topics we cover, from the best furniture materials in India to the latest semiconductor import data, intersect with JP Morgan’s financial ecosystem. Below, the curated articles break down real‑world examples, data‑driven insights, and practical steps you can apply whether you’re a factory owner, a supply‑chain analyst, or an investor watching the market.

JP Morgan serves as the common thread that ties together capital markets, industry research, and on‑the‑ground manufacturing decisions. Dive into the posts to discover how its services shape the stories you’re about to read.

The article explores the relationship between U.S. Steel and JP Morgan, delving into historical ties and current ownership structures. It highlights the differences in organizational involvement over time and dispels common misconceptions about JP Morgan's ownership of U.S. Steel. Several insights into the steel manufacturing industry are provided to give a clearer understanding of the major players. Readers will gain an appreciation for the history and evolution of these formidable entities in the industrial sector. (Read More)